Revenue types are defined for the system. Tax and Gratuity Schedules are defined for each store. The Revenue Type Association area is the place where the schedules (and therefore the tax and gratuity values) are connected to the system wide revenue types (which are in turn connected to products to be sold on the storefront). This allows different stores to have varying taxes and gratuities as necessary but to be able to provide revenue reporting for the entire system. This is also where unique accounting codes for each revenue type are defined.

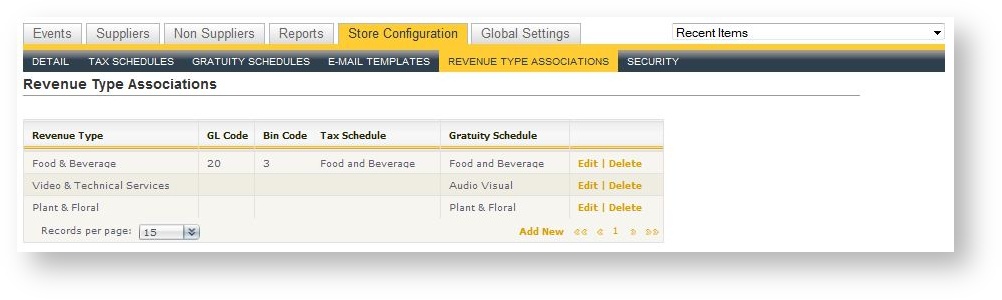

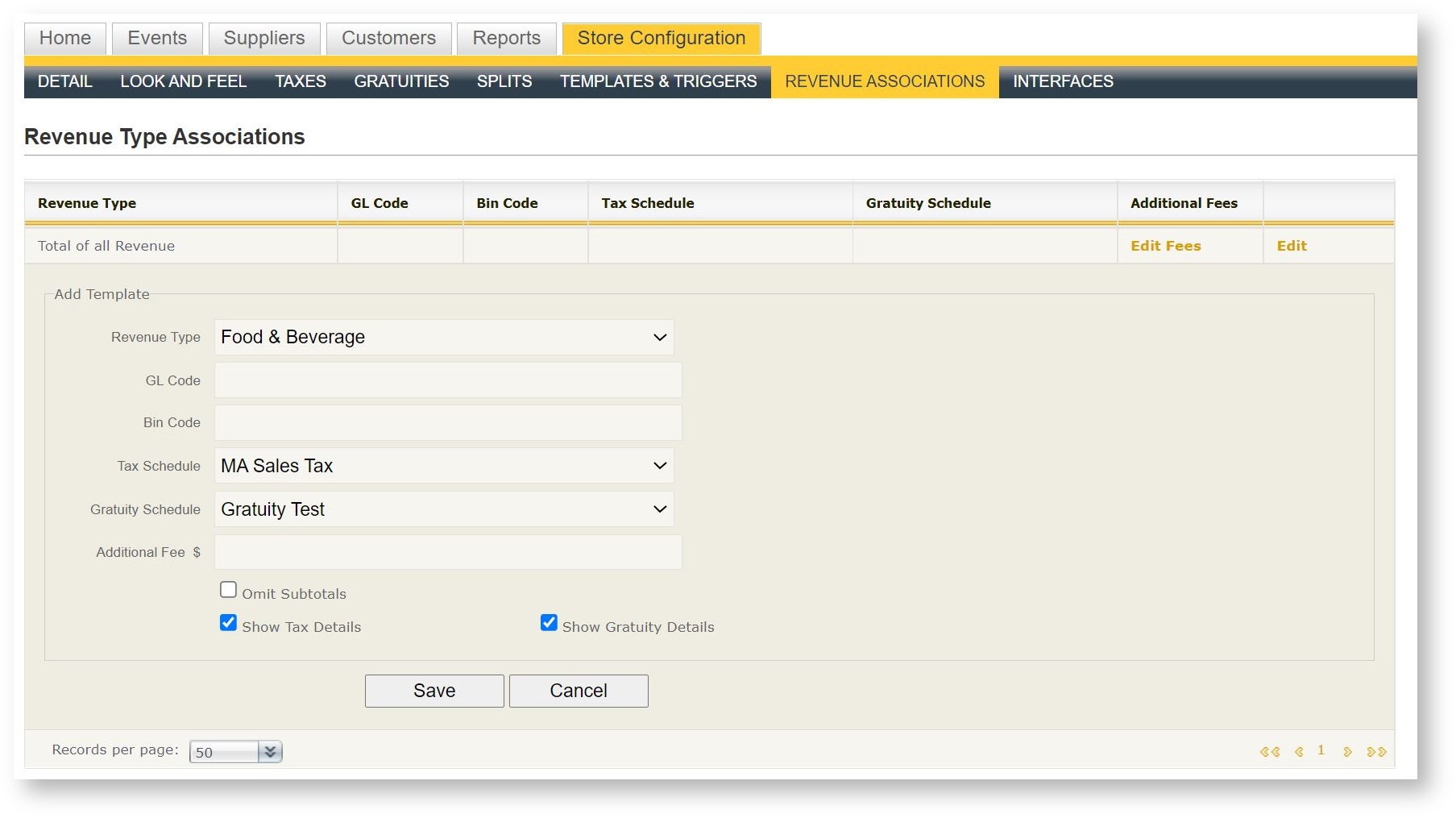

The revenue type association grid lists all revenue types that have been associated to tax and gratuity schedules within the store:

| Field Name | Description |

|---|---|

|

Revenue Type |

The revenue type being defined by the row. |

|

GL Code |

Each revenue type gets a unique general ledger (GL) code per store. A GL code is alphanumeric and will be used in the interface with the accounting system. |

| Bin Code | This is a more generic code used for interfaces to other systems. |

| Tax Schedule | The tax schedule to be applied to this revenue type. |

| Gratuity Schedule |

The gratuity schedule to be applied to this revenue type. |

| Additional Fee |

If additional fees apply. |